Introduction

Getting an Employer Identification Number (EIN) is a crucial step for any business. It serves as your unique identifier with the IRS. This number not only simplifies tax reporting and compliance but also boosts your business's credibility and makes banking easier. Yet, many entrepreneurs feel overwhelmed by the application process and the many requirements involved.

Have you ever felt lost trying to navigate this? What are the key steps to successfully tackle this journey? It’s essential to know how to avoid common pitfalls along the way. Remember, you’re not alone in this fight - we’re here to guide you through every step.

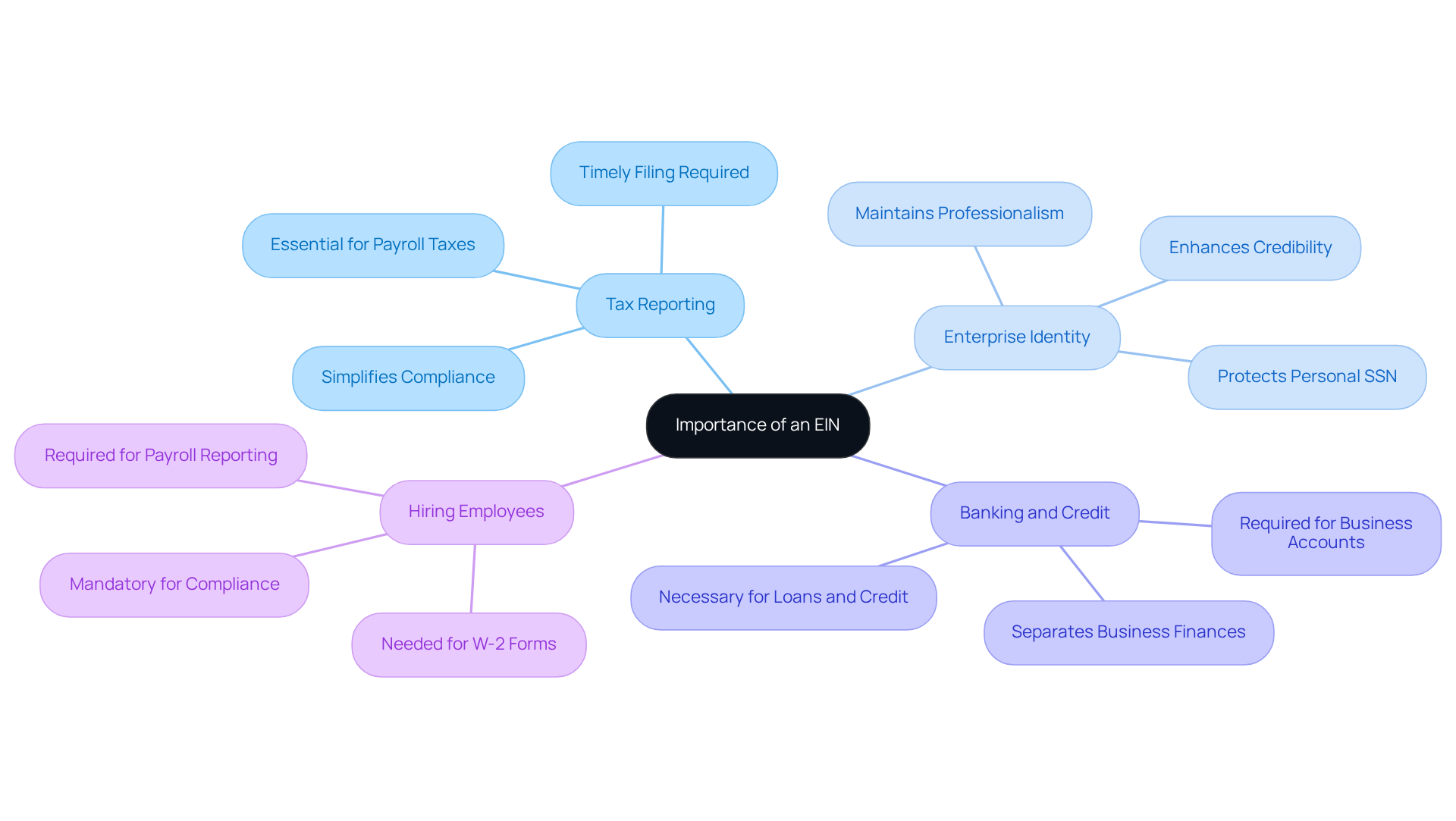

Understand the Importance of an EIN

An Employer Identification Number (EIN) is a unique nine-digit identifier issued by the IRS, and it’s crucial for any business entity for several key reasons:

-

Tax Reporting: Filing business tax returns and managing payroll taxes requires an EIN. It simplifies compliance with federal and state tax obligations, helping organizations operate smoothly without administrative delays. The IRS emphasizes timely filing, making the EIN essential for staying on the right side of regulations.

-

Enterprise Identity: Think of the EIN as your federal tax ID. It sets your organization apart, protecting your personal Social Security number while boosting your entity's credibility. This separation is vital for maintaining professionalism in dealings with clients and suppliers. An EIN employer ID number helps keep personal and business finances distinct, reinforcing your liability protections.

-

Banking and Credit: Almost every bank requires an EIN to open a corporate bank account, which is essential for managing income and expenses separately. Plus, if you’re looking to apply for loans or credit, an EIN employer ID number is often necessary. Securing one positions your enterprise for success, paving the way for efficient operations and growth.

-

Hiring Employees: Planning to hire? An EIN employer ID number is essential for reporting payroll taxes and issuing W-2 forms. This underscores the importance of having an EIN employer ID number to comply with employment regulations. By 2026, nearly all businesses that employ staff or operate as corporations or partnerships will need one. Small business owners, who are vital to the economy, shouldn’t face long delays for such a fundamental identification number.

Acquiring an EIN offers lasting advantages since it never expires, ensuring stability and peace of mind for entrepreneurs. By understanding these elements, you can see why obtaining an EIN is a crucial step as you embark on your business journey.

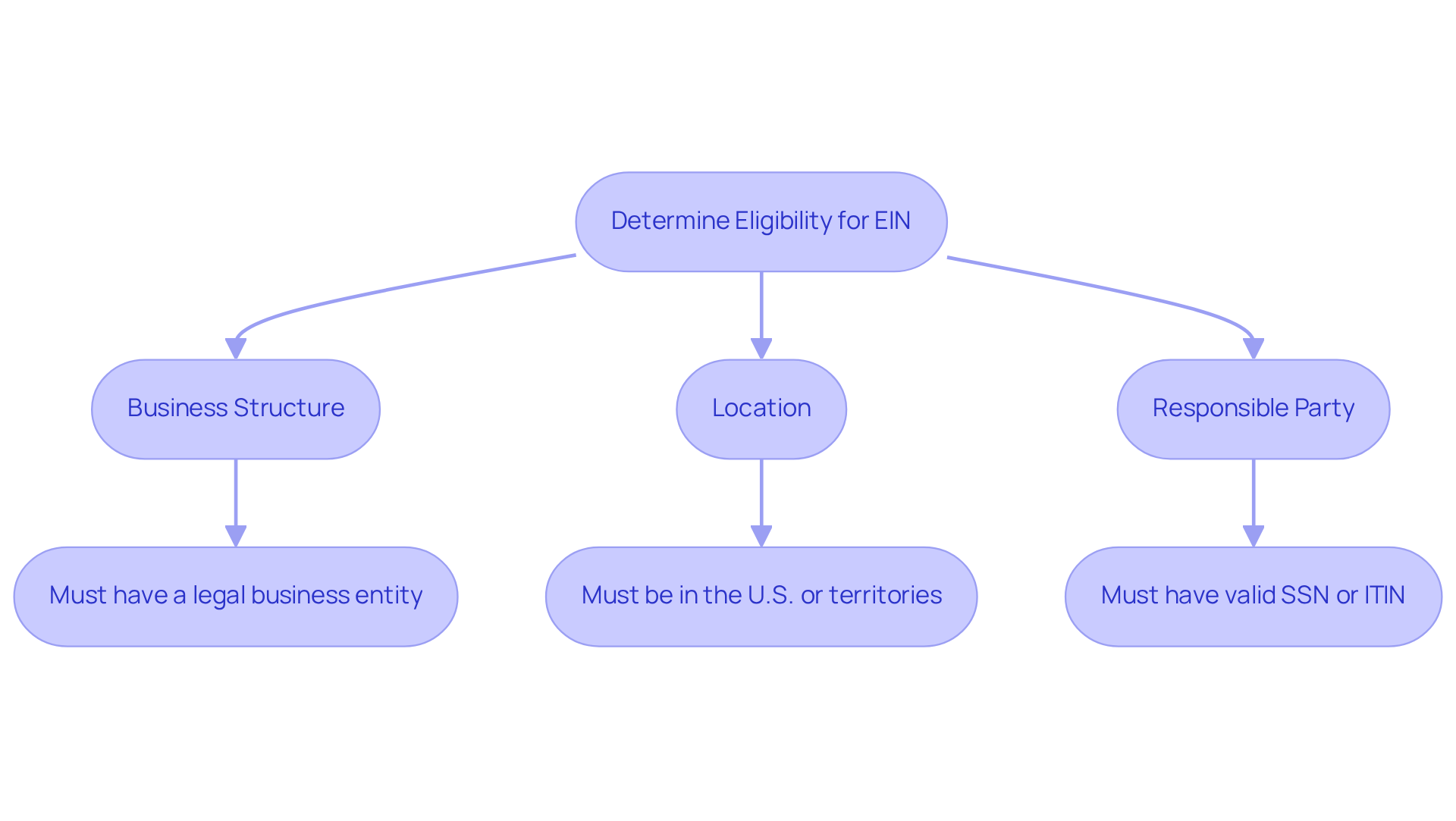

Determine Your Eligibility for an EIN

Applying for an ein employer id number can feel daunting, but it doesn’t have to be. Let’s break it down together. First, you need to confirm your eligibility based on a few key criteria:

-

Business Structure: You must have a legal business entity. This can be a corporation, partnership, or limited liability company (LLC). Even sole proprietors can apply! Did you know that by 2026, about 70% of new businesses are expected to be LLCs or corporations? This shift highlights the importance of having a recognized business structure. The IRS states, "Generally you need an EIN to: Hire employees, Operate a partnership or corporation..."

-

Location: Your main place of business must be in the U.S. or its territories to qualify for an EIN.

-

Responsible Party: The application must be submitted by a responsible party-usually someone with a valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). This ensures that the EIN is linked to a legitimate person who is accountable for the organization’s tax responsibilities.

The easiest and fastest way to get your EIN? Apply online! Just a heads up: be wary of websites that charge for this service. You should never have to pay a fee for an EIN.

If you meet these criteria, you’re ready to move forward with the EIN employer ID number registration process. Remember, you’re not alone in this fight-we’re here to support you every step of the way.

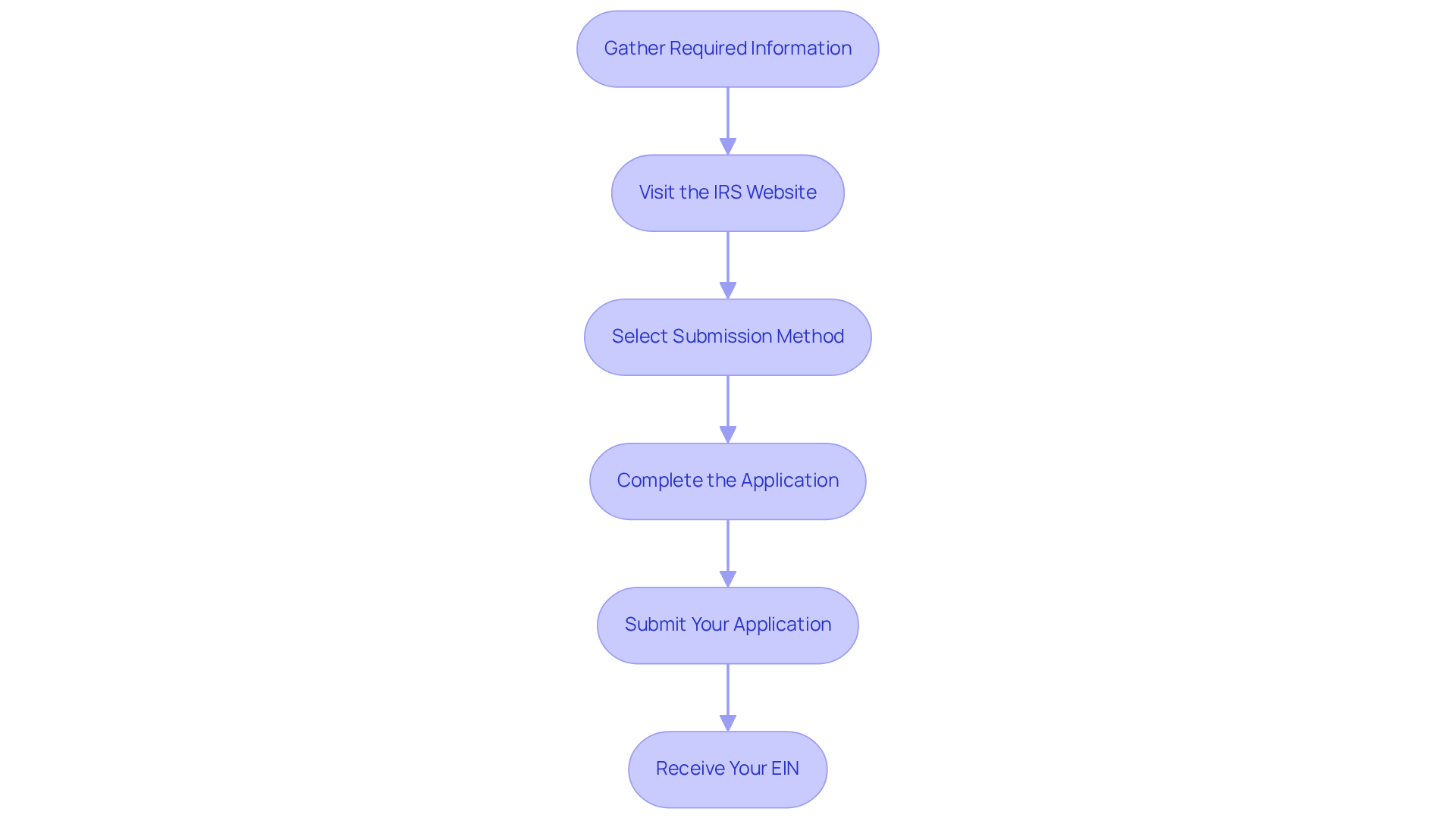

Follow the Step-by-Step Application Process

Applying for your EIN can feel overwhelming, but you don’t have to navigate it alone. Here’s a straightforward guide to help you through the process:

- Gather Required Information: Start by collecting essential details like your business name, address, and the responsible party's SSN or ITIN. Having this information ready will make your submission smoother.

- Visit the IRS Website: Head over to the IRS EIN registration page to kick off your application.

- Select Submission Method: Choose how you want to submit your application: online, by fax, or by mail. The online option is the fastest, giving you your EIN right away.

- Complete the Application: Carefully fill out Form SS-4, ensuring all details are accurate. Pay close attention to the legal name of your business and the responsible party's information - mistakes can lead to delays.

- Submit Your Application: If you’re applying online, submit the form directly through the IRS website. For fax or mail submissions, send it to the appropriate address listed on the IRS site.

- Receive Your EIN: If you applied online, expect to get your EIN immediately. Fax submissions typically take about four business days, while mailed applications may take up to four weeks.

By following these steps and double-checking your information, you can tackle the EIN registration process with confidence. Remember, we’re here to fight for your family and ensure you have the support you need.

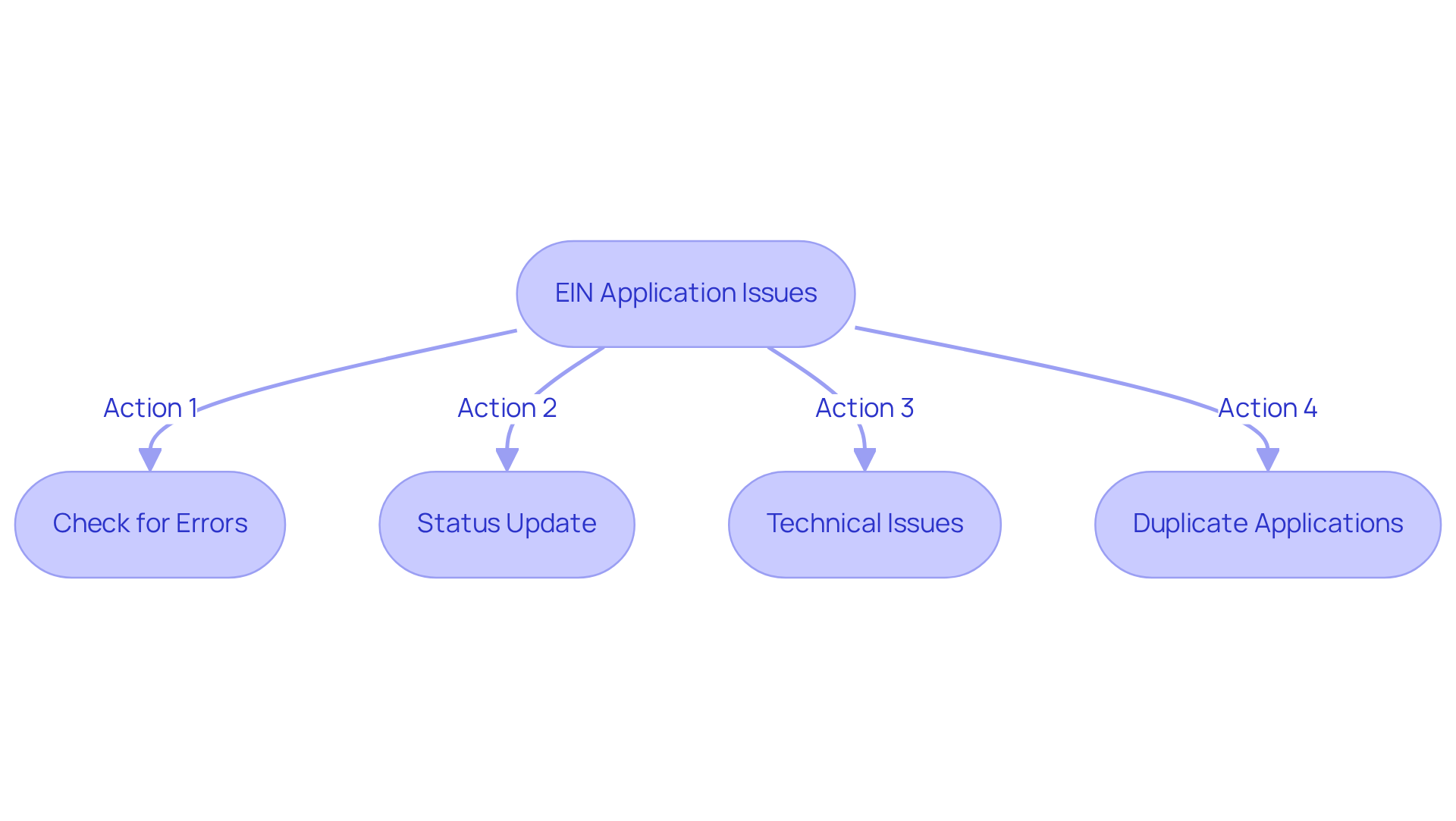

Troubleshoot Common EIN Application Issues

Facing issues while applying for your EIN? You’re not alone. Here are some practical tips to help you navigate this process:

- Check for Errors: Make sure all your information matches your legal documents. Common mistakes include mismatched names or incorrect Social Security Numbers.

- Status Update: If your EIN doesn’t arrive when expected, don’t hesitate to check the IRS website for updates or call the IRS Business & Specialty Tax Line at 800-829-4933.

- Technical Issues: If the online system is down, try again later. You can also apply by fax or mail if that’s easier for you.

- Duplicate Applications: Avoid sending multiple applications for the same EIN. This can create confusion and delays. If you think there’s been an error, reach out to the IRS for clarification.

By following these steps, you can tackle common issues and successfully secure your EIN employer ID number. Remember, we’re here to fight for your family and support you every step of the way.

Conclusion

Securing an Employer Identification Number (EIN) is a crucial step in launching your business. This unique identifier not only helps you stay compliant with tax regulations but also boosts your credibility and simplifies banking and employee management. Recognizing the importance of an EIN is key to laying a solid foundation for your business's success.

In this article, we’ve covered the essentials of obtaining an EIN. From understanding its significance and checking your eligibility to following a straightforward application process, we’ve got you covered. Remember, having a legal business structure and providing accurate information during your application are vital. Plus, we’ve addressed common issues that might pop up along the way. Being prepared and informed is your best strategy when tackling the EIN application.

But let’s be clear: getting an EIN isn’t just another bureaucratic hurdle; it’s an investment in your business’s future. By taking the right steps to secure this important number, you’re not only ensuring compliance with tax laws but also protecting your personal information and setting the stage for growth and success. Embracing this process is essential for anyone who wants to thrive in today’s competitive business landscape.

We’re here to fight for your success. Your future matters to us. Yo Peleo - We Fight.

Frequently Asked Questions

What is an Employer Identification Number (EIN)?

An Employer Identification Number (EIN) is a unique nine-digit identifier issued by the IRS that is essential for any business entity.

Why is an EIN important for tax reporting?

An EIN is crucial for filing business tax returns and managing payroll taxes, simplifying compliance with federal and state tax obligations, and helping organizations avoid administrative delays.

How does an EIN enhance enterprise identity?

An EIN serves as a federal tax ID, protecting personal Social Security numbers, boosting the entity's credibility, and maintaining a separation between personal and business finances.

What role does an EIN play in banking and credit?

An EIN is often required by banks to open a corporate bank account, which is essential for managing income and expenses separately. It is also necessary for applying for loans or credit.

Is an EIN necessary for hiring employees?

Yes, an EIN is essential for reporting payroll taxes and issuing W-2 forms when hiring employees, and it will be required for nearly all businesses that employ staff by 2026.

How long does an EIN last?

An EIN never expires, providing stability and peace of mind for entrepreneurs throughout their business journey.