Overview

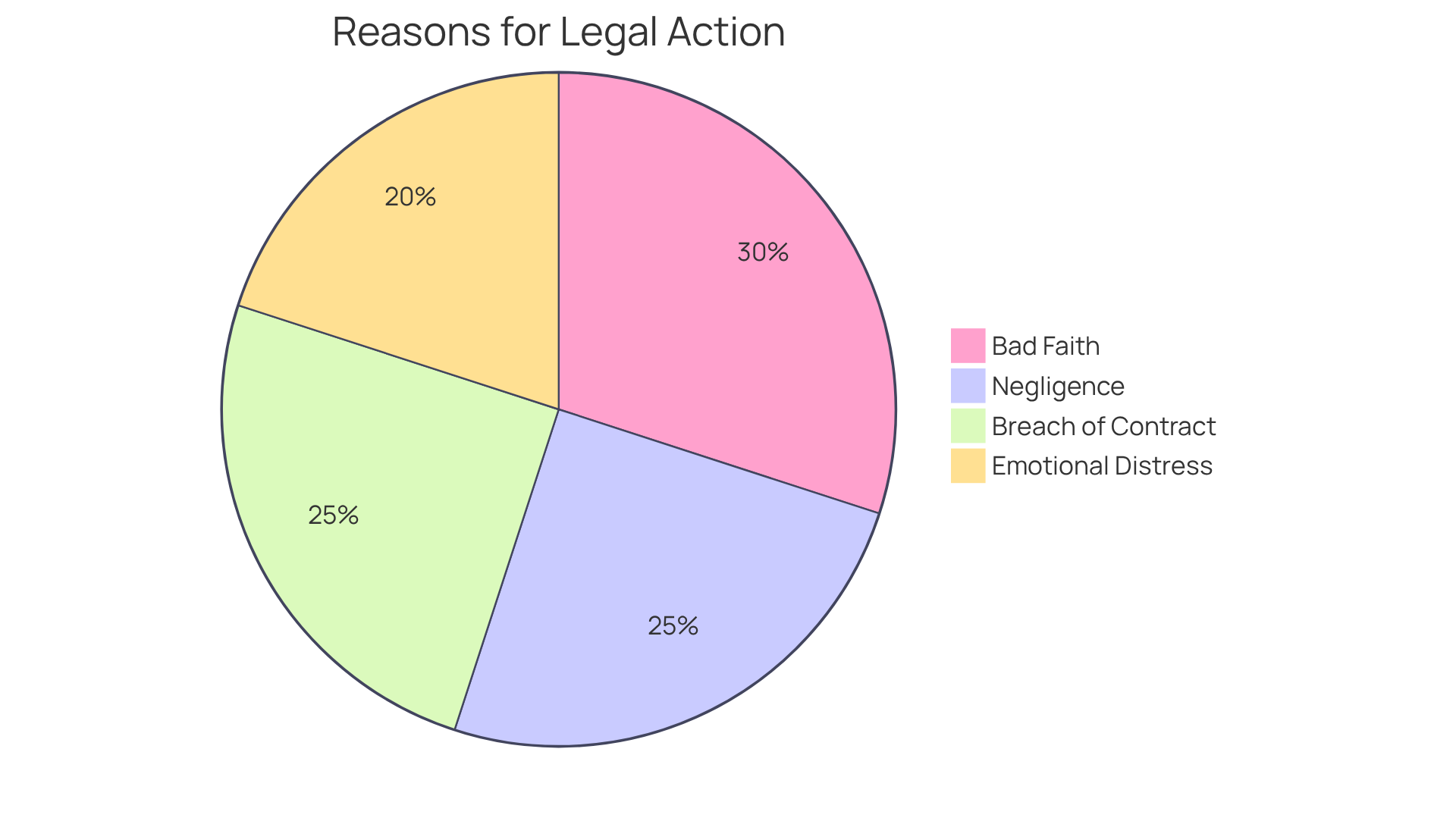

Suing your insurance company can feel daunting. Have you ever felt lost when dealing with claims? It’s crucial to identify valid grounds for your case—like:

- Bad faith

- Negligence

- Breach of contract

- Emotional distress

Gathering solid evidence to back your claim is essential.

Understanding these reasons and documenting your case meticulously is key to navigating the lawsuit process successfully. You’ll need to file the right legal documents and manage any appeals that may come up. Remember, you’re not alone in this fight. We’re here to support you every step of the way.

Your rights matter, and we’re committed to fighting for you. Let’s take action together!

Introduction

Navigating the complex world of insurance claims can feel like an uphill battle. Have you ever faced denials or delays that seem unjust? Many individuals wonder if they have grounds to take legal action against their insurance company. This guide outlines essential steps to successfully sue an insurance provider—from identifying valid reasons for a lawsuit to gathering crucial evidence and managing the legal process.

But what happens when the very entity meant to protect you becomes an obstacle? It’s important to know you have rights, even if others tell you otherwise. Exploring the intricacies of this challenging landscape reveals not only the potential for resolution but also the empowerment that comes from understanding your rights in the face of adversity. Remember, you’re not alone in this fight—we’re here to support you every step of the way.

Identify Reasons to Sue Your Insurance Company

Before understanding how to sue an insurance company, it’s crucial to pinpoint the reasons that support your case. Here are some common grounds for pursuing legal action:

- Bad Faith: Insurers must act in good faith. If they deny a legitimate claim without a solid reason or delay payment unnecessarily, they might be acting in bad faith. Did you know that around 10% to 20% of claims face initial rejection or delay? This is a significant issue that many encounter.

- Negligence: This happens when an insurance company mishandles your claim, leading to financial loss. For example, a trucking firm in Pennsylvania successfully defended itself against wrongful accusations, showcasing the importance of proper claim handling.

- Breach of Contract: If your insurer doesn’t uphold the terms of your policy—like denying coverage for a covered event—that’s a breach of contract. Legal experts stress the importance of understanding your policy’s details in these cases.

- Emotional Distress: Sometimes, an insurer’s actions can cause significant emotional distress for the claimant. This can be a valid basis for a lawsuit, especially if the insurer’s behavior worsens the claimant’s situation.

Evaluating your circumstances against these standards can help you understand how to sue an insurance company if you have a legitimate case to pursue. Understanding these reasons is vital, especially with the increasing number of disputes, which involved nearly $970 million in face-value disputes by the end of 2022. Remember, you’re not alone in this fight—we’re here to support you every step of the way.

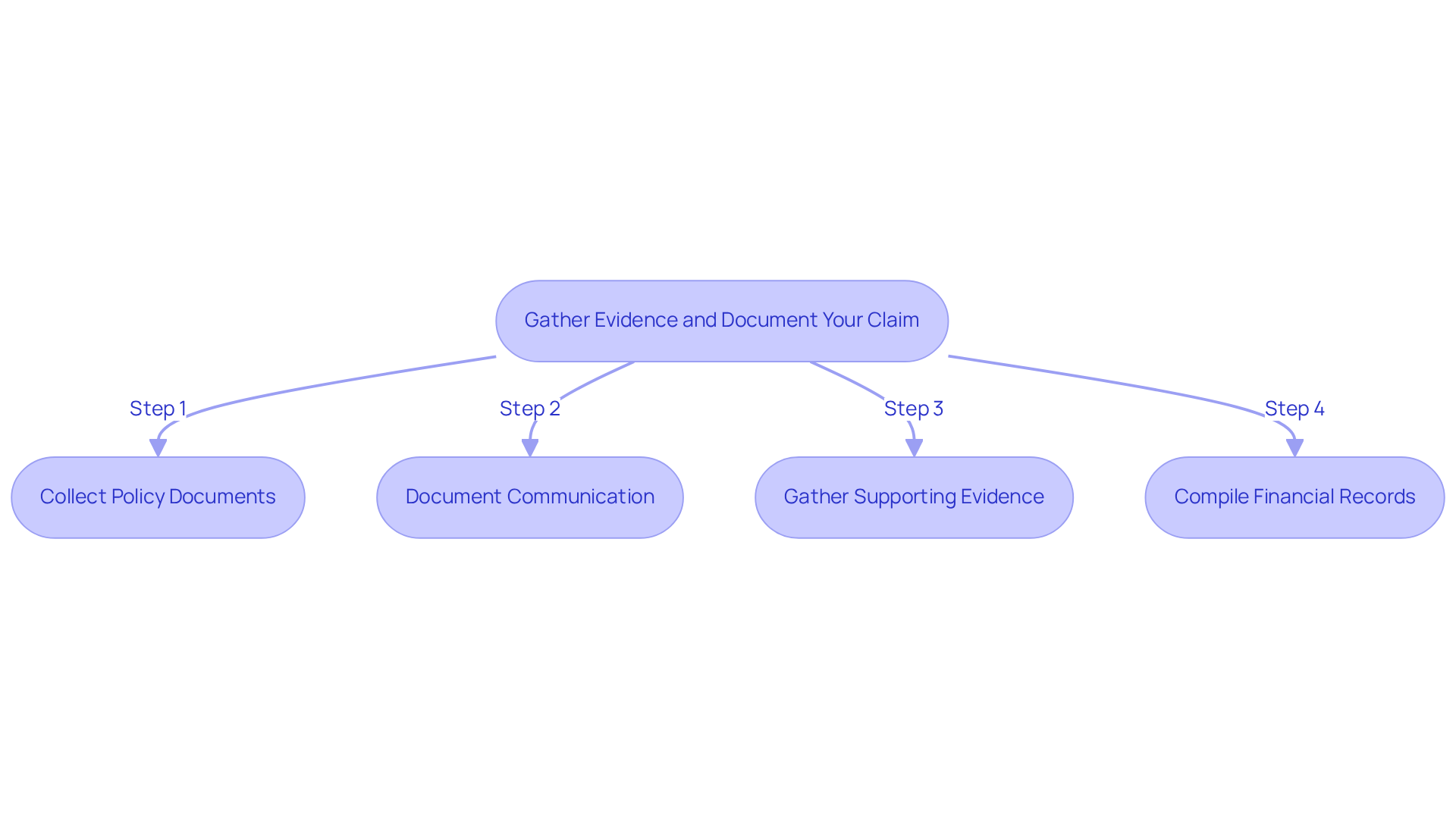

Gather Evidence and Document Your Claim

To strengthen your position, it’s essential to gather all relevant evidence and documentation related to your situation. Remember, you have rights as an injured worker under the workers' compensation system—Usted Tiene Derechos Como Trabajador Lesionado. Here’s how to take action:

- Collect Policy Documents: Make sure you have a copy of your insurance policy, including any endorsements or amendments. This will clarify your coverage and obligations.

- Document Communication: Keep a detailed log of all communications with the insurance company. Note the dates, times, and names of representatives you spoke with. This record can be invaluable if disputes arise, as clear communication is key in managing issues.

- Gather Supporting Evidence: This may include:

- Photos or videos of the incident or damage, serving as visual proof of your claims.

- Medical records, if applicable, to substantiate any injuries and related expenses.

- Witness statements that support your account, enhancing the credibility of your assertion.

- Any correspondence from the insurer regarding your request, which can highlight their responses and decisions.

- Compile Financial Records: Document any financial losses incurred due to the insurer's actions, such as repair costs or medical expenses. This financial evidence is crucial in establishing the impact of the insurer's decisions on your life.

Having a thorough compilation of evidence is vital in showcasing how to sue an insurance company in court. Comprehensive documentation not only backs your assertion but also positions you advantageously when considering how to sue insurance company. Remember, you’re not alone in this fight—we’re here to support you every step of the way.

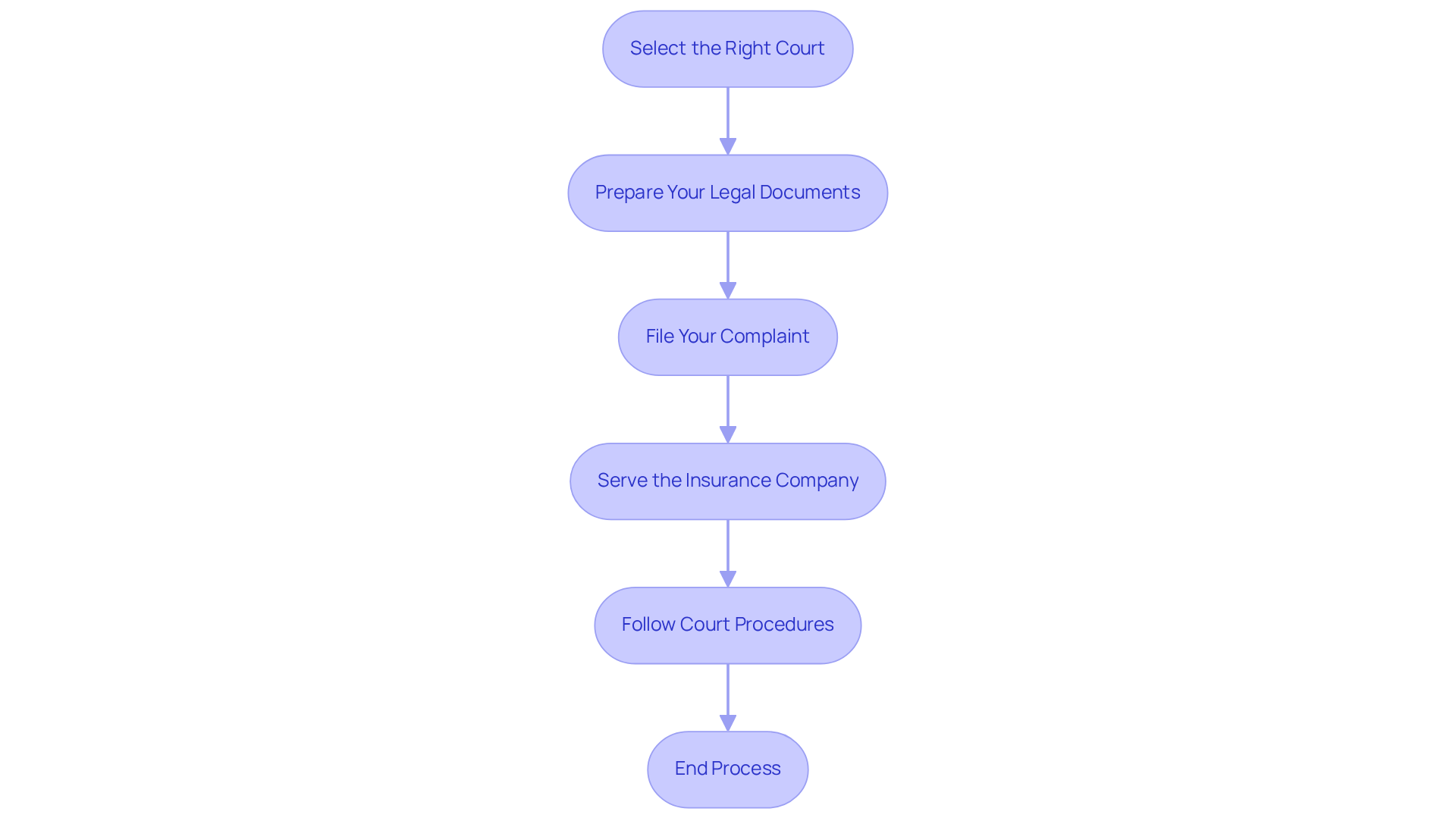

File the Lawsuit and Navigate Legal Procedures

Filing a lawsuit can feel overwhelming, but you don’t have to navigate this alone. Here’s a straightforward guide to help you through the process:

-

Select the Right Court: Think about whether your case belongs in small claims court or a higher court. If you’re pursuing a smaller amount, small claims court is often the best choice. It’s designed for simpler claims and is more accessible.

-

Prepare Your Legal Documents: You’ll need to draft essential legal documents, including a complaint that outlines your situation and what you’re seeking. Keep your complaint clear and concise; this clarity is crucial for presenting your case effectively.

-

File Your Complaint: Once your documents are ready, submit your complaint to the appropriate court and pay any filing fees. In North Carolina, these fees can vary, so it’s important to check the specific costs for your case.

-

Serve the Insurance Company: After filing, you must serve the insurance company with a copy of your complaint and a summons. This step is vital; it ensures the insurance firm knows about the lawsuit against them.

-

Follow Court Procedures: Be ready to attend hearings, respond to motions, and comply with court orders throughout the litigation process. Understanding the court’s procedures will help you navigate this journey more effectively.

Taking these steps carefully will help ensure your lawsuit is filed correctly and on time. Remember, understanding how to sue insurance company is crucial for successful lawsuits in small claims court, as it often hinges on thorough preparation and following judicial protocols. You’re not alone in this fight—we’re here to support you every step of the way.

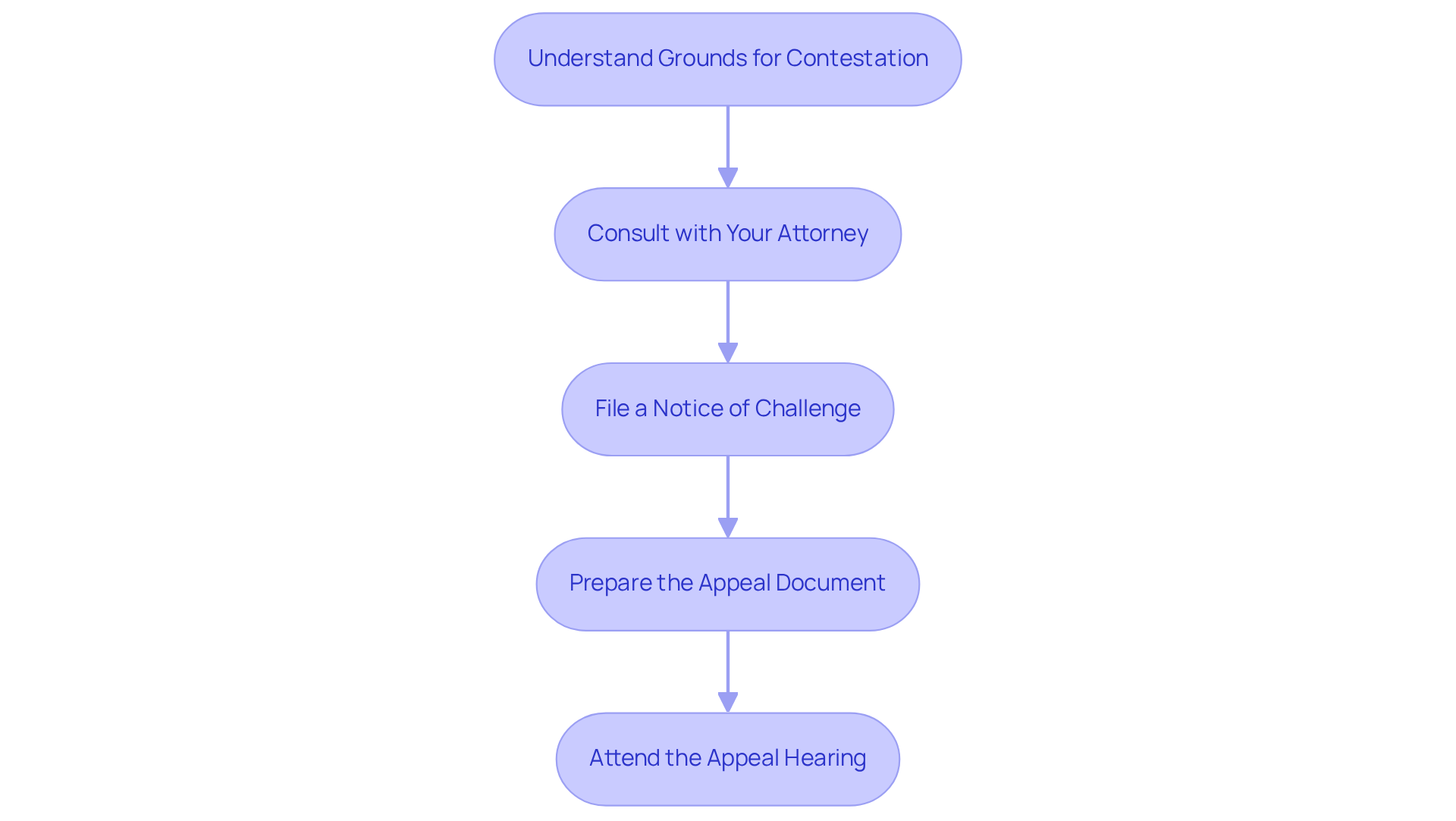

Manage Appeals and Overcome Legal Challenges

If your case doesn’t end in your favor, you might have the option to challenge that decision. Here’s how to navigate this process effectively:

-

Understand the Grounds for Contestation: Get to know the valid reasons for a challenge. This could include legal errors during the trial or new evidence that could sway the outcome. Common reasons for contesting a decision are procedural errors, misinterpretation of the law, and insufficient evidence supporting the initial ruling.

-

Consult with Your Attorney: Have a thorough discussion with your attorney to weigh your options and see if pursuing a challenge makes sense. Legal experts emphasize that a solid request can significantly boost your chances of success, especially when it’s backed by strong arguments and documented proof. If you’re facing urgent legal issues—like ICE enforcement actions, DUI arrests, or domestic violence charges—remember that Vasquez Law Firm offers free consultations and 24/7 emergency support for personal injury cases. Don’t hesitate to reach out for immediate help at 1-844-967-3536.

-

File a Notice of Challenge: If you decide to move forward, make sure to file a notice of challenge within the court’s specified timeframe, which usually ranges from 30 to 180 days based on your insurance plan. Missing this deadline could mean losing your chance to contest.

-

Prepare the Appeal Document: Work closely with your attorney to draft a comprehensive document that clearly lays out your arguments and the legal basis for your request. A well-organized brief is crucial, as it serves as the foundation for your argument in the appellate court. Strong requests rely on thorough documentation that aligns directly with coverage criteria.

-

Attend the Appeal Hearing: Be prepared to present your case before the appellate court, focusing on the legal issues rather than rehashing the facts of the original case. Successful requests for reconsideration often hinge on your ability to clearly articulate how the trial court erred in its judgment.

Recent trends show that about 44% of patients who contest their denials succeed at the initial internal review level, underscoring the importance of a strategic approach. Additionally, a well-structured request can boost your success rate by as much as 60%. Successful appeals often depend on thorough documentation, including clinical narratives and supporting evidence, which can significantly bolster your case. By understanding the appeals process and preparing diligently, you can enhance your chances of overcoming challenges and securing the compensation you deserve. Remember, if you face any urgent legal issues, Vasquez Law Firm is here 24/7 to provide the support you need.

Conclusion

Understanding how to sue an insurance company is crucial for anyone facing unfair treatment from their insurer. This guide highlights the essential steps to take, ensuring you have the knowledge needed to navigate the complexities of legal action against insurance providers effectively.

First, let’s recognize the real struggles you might be facing. Have you ever felt lost when dealing with your insurance? This article outlines four key steps:

- Identifying valid reasons to sue

- Gathering necessary evidence

- Filing the lawsuit while following legal procedures

- Managing any appeals that may arise

Each step emphasizes the importance of preparation, documentation, and understanding your rights. Remember, you’re not alone in this journey; support is available when you need it.

In the face of potential insurance disputes, taking proactive measures can significantly impact the outcome of your case. By recognizing the grounds for legal action and meticulously documenting your interactions and evidence, you can bolster your chances of success. Ultimately, standing up against unfair practices not only serves your personal interests but also contributes to a collective push for accountability within the insurance industry.

We’re here to fight for your family. Your future matters to us. Yo Peleo — We Fight.

Frequently Asked Questions

What are the common reasons to sue an insurance company?

Common reasons include bad faith, negligence, breach of contract, and emotional distress.

What does "bad faith" mean in the context of insurance?

"Bad faith" refers to an insurance company denying a legitimate claim without a solid reason or unnecessarily delaying payment.

How prevalent are claim rejections or delays?

Approximately 10% to 20% of claims face initial rejection or delay.

What constitutes negligence by an insurance company?

Negligence occurs when an insurance company mishandles a claim, resulting in financial loss to the claimant.

What is a breach of contract in an insurance context?

A breach of contract happens when an insurer fails to uphold the terms of the policy, such as denying coverage for a covered event.

Can emotional distress be a valid reason to sue an insurance company?

Yes, if an insurer's actions cause significant emotional distress, it can be a valid basis for a lawsuit.

Why is it important to understand the reasons for suing an insurance company?

Understanding these reasons is vital due to the increasing number of disputes, which involved nearly $970 million in face-value disputes by the end of 2022.