Overview

North Carolina operates under an at-fault insurance system, which means that if you’re injured, you must prove the other driver was at fault to receive compensation. This can be a daunting challenge, especially given the strict contributory negligence rule. Did you know that if you are found even 1% at fault, you could be completely barred from recovery? This emphasizes the critical need for clear evidence to support your claims.

We understand how overwhelming this feels. Navigating these legal waters can be confusing, but you don’t have to face it alone. We’re here to fight for your rights and help you gather the evidence you need. Remember, your future matters to us, and we’ll guide you every step of the way.

Let’s take action together—your fight is our fight.

Introduction

Navigating the complexities of car insurance laws can feel overwhelming, particularly when determining fault after an accident. In the United States, no-fault insurance aims to simplify compensation for injured parties, enabling them to receive payments without needing to prove fault. However, in North Carolina, the landscape is different; here, proving the other party's liability is crucial for recovery.

This situation raises an essential question: how does North Carolina's at-fault system affect the rights of accident victims? What do they need to know to navigate their claims with confidence? We’re here to guide you through this challenging process.

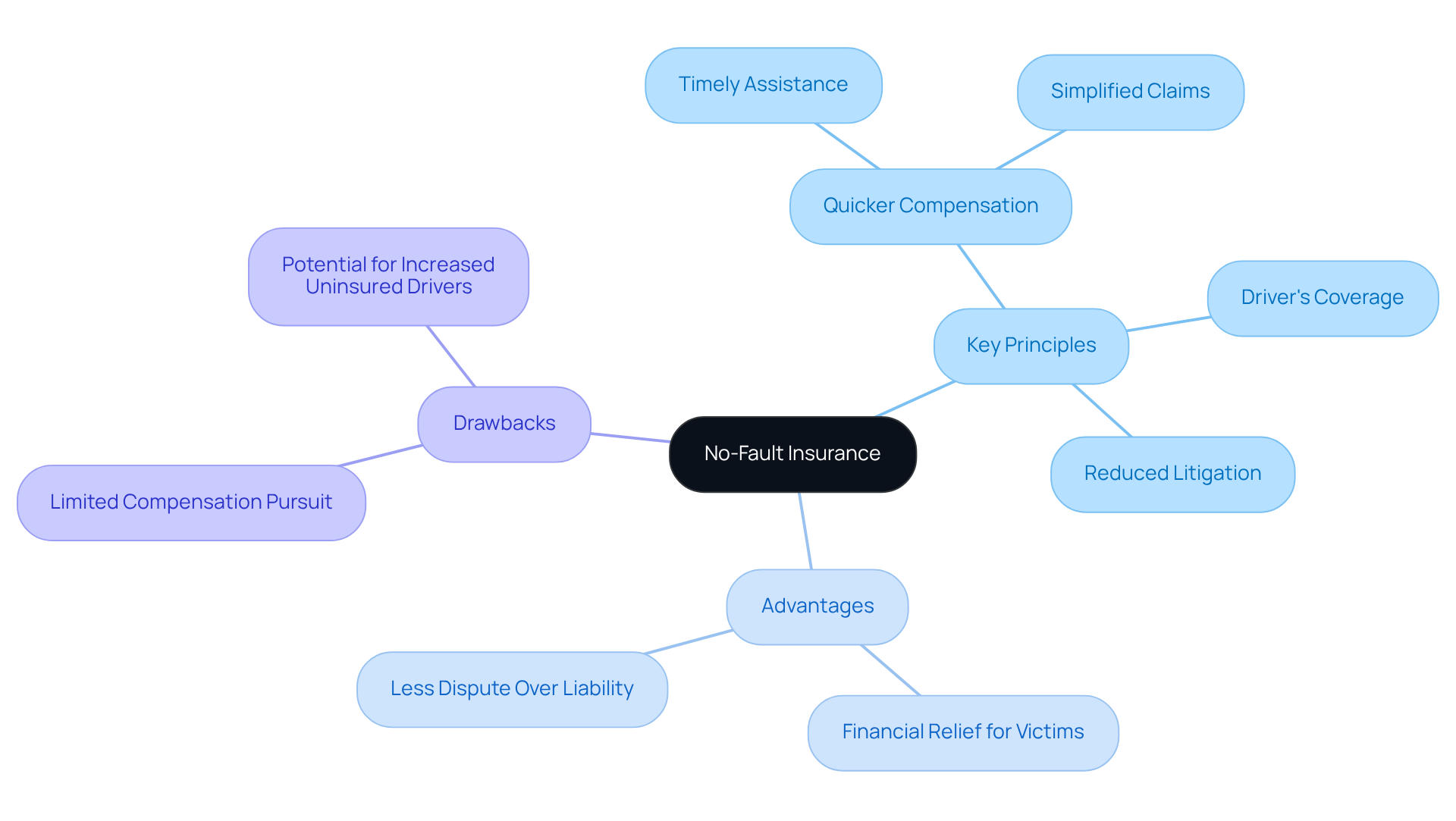

Define No-Fault Insurance: Key Principles and Mechanisms

A key aspect of understanding whether North Carolina is a no-fault state is that no-fault coverage is a specialized form of automobile protection designed to facilitate quicker compensation for policyholders' injuries and damages without needing to establish fault in an accident. This system operates on the principle that each driver's coverage pays for their own medical costs and lost income, no matter who is at fault. By minimizing the need for litigation, no-fault coverage aims to expedite payments to injured parties, ensuring they receive timely assistance during recovery.

In the United States, approximately 12 states have implemented no-fault coverage systems, which leads to the inquiry: is North Carolina a no-fault state, given the various levels of protection and requirements these systems feature? However, this number may change as some states are revising their no-fault laws in 2025. The primary advantage of this approach is the reduction of disputes over liability, which can often delay compensation. While no-fault coverage simplifies the claims procedure, it may also limit victims' ability to pursue compensation in specific circumstances, particularly when harm does not meet a designated severity level.

Experts emphasize that no-fault coverage can significantly alleviate the financial burden on accident victims. Michael Carlson, president of the Personal Insurance Federation of Florida, states, "The shift could result in more uninsured drivers and a rise in litigation due to the new bodily injury coverage requirements." This highlights the importance of understanding if North Carolina is a no-fault state within the evolving landscape of no-fault coverage. Moreover, the system fosters a more efficient claims process, as insurers are required to cover medical costs and lost income swiftly, thus enhancing the overall experience for those affected by incidents.

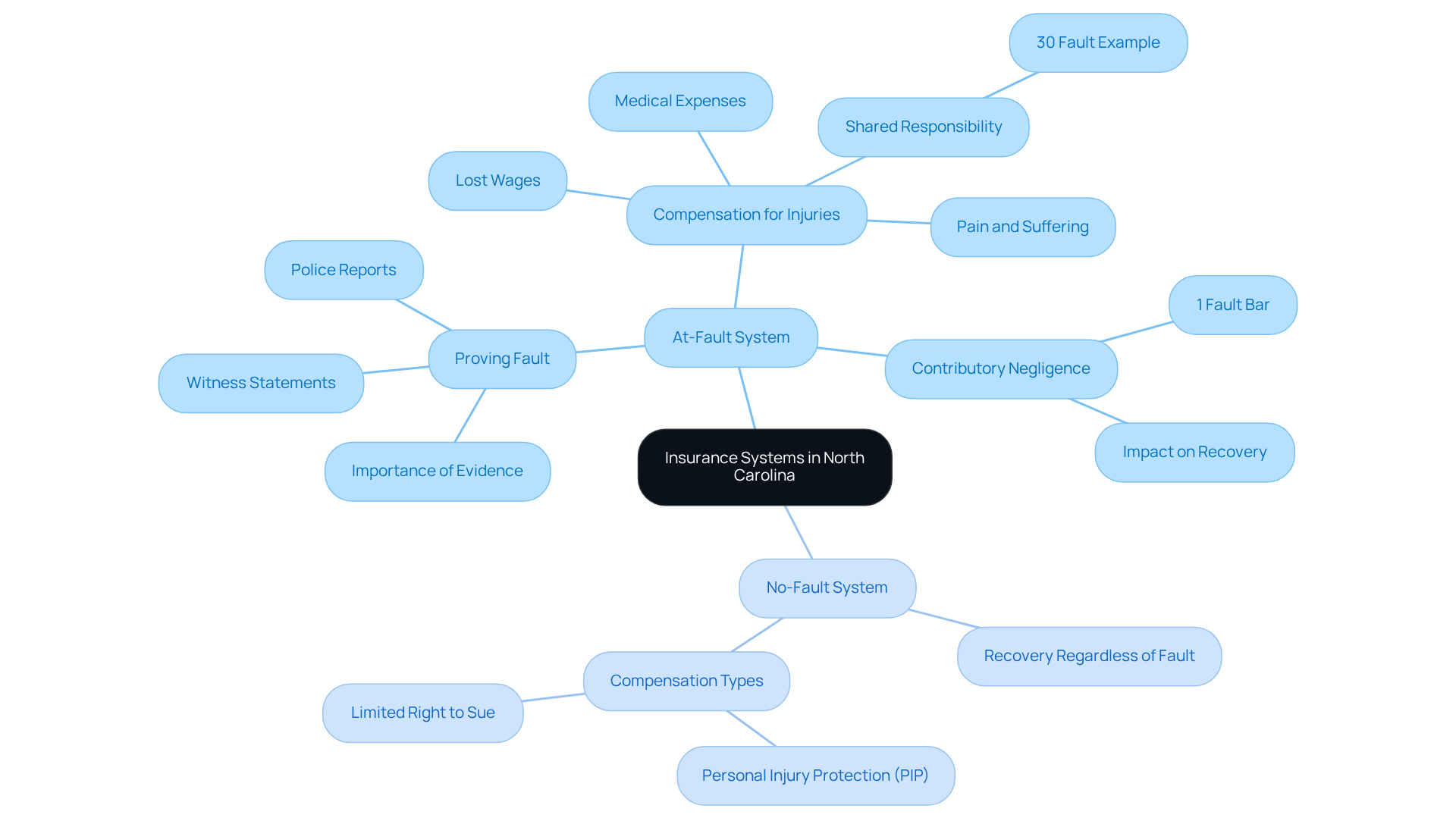

Contrast No-Fault and At-Fault Insurance Systems: Implications for North Carolina Drivers

In North Carolina, the liability coverage system requires injured individuals to prove that the other driver was at fault to receive compensation. This legal framework can complicate claims, as determining fault often involves thorough investigations and negotiations. Unlike no-fault systems that allow each party to recover from their own coverage regardless of fault, it raises the question, is North Carolina a no-fault state, which can offer more substantial compensation options for serious injuries. Victims can seek damages not just for medical expenses, but also for pain and suffering, lost wages, and other losses.

For instance, if a driver is found to be 30% at fault in a collision, they can still recover 70% of their damages. This demonstrates that substantial compensation is possible, even with shared responsibility. Legal experts stress the importance of gathering evidence, such as witness statements and police reports, to support claims in this at-fault environment.

Understanding these differences is crucial for North Carolina motorists when selecting insurance policies and preparing for potential incidents. The state's contributory negligence law can prevent recovery if the injured individual is deemed even 1% at fault.

At Vasquez Law Firm, we operate on a contingency fee basis for personal injury cases, meaning you pay nothing unless we win. This ensures that financial constraints never hinder your pursuit of justice. With direct access to knowledgeable lawyers who truly understand your situation, we are dedicated to providing tailored legal representation throughout North Carolina and Florida. We simplify the navigation of your rights and options following an incident, because we’re here to fight for your family.

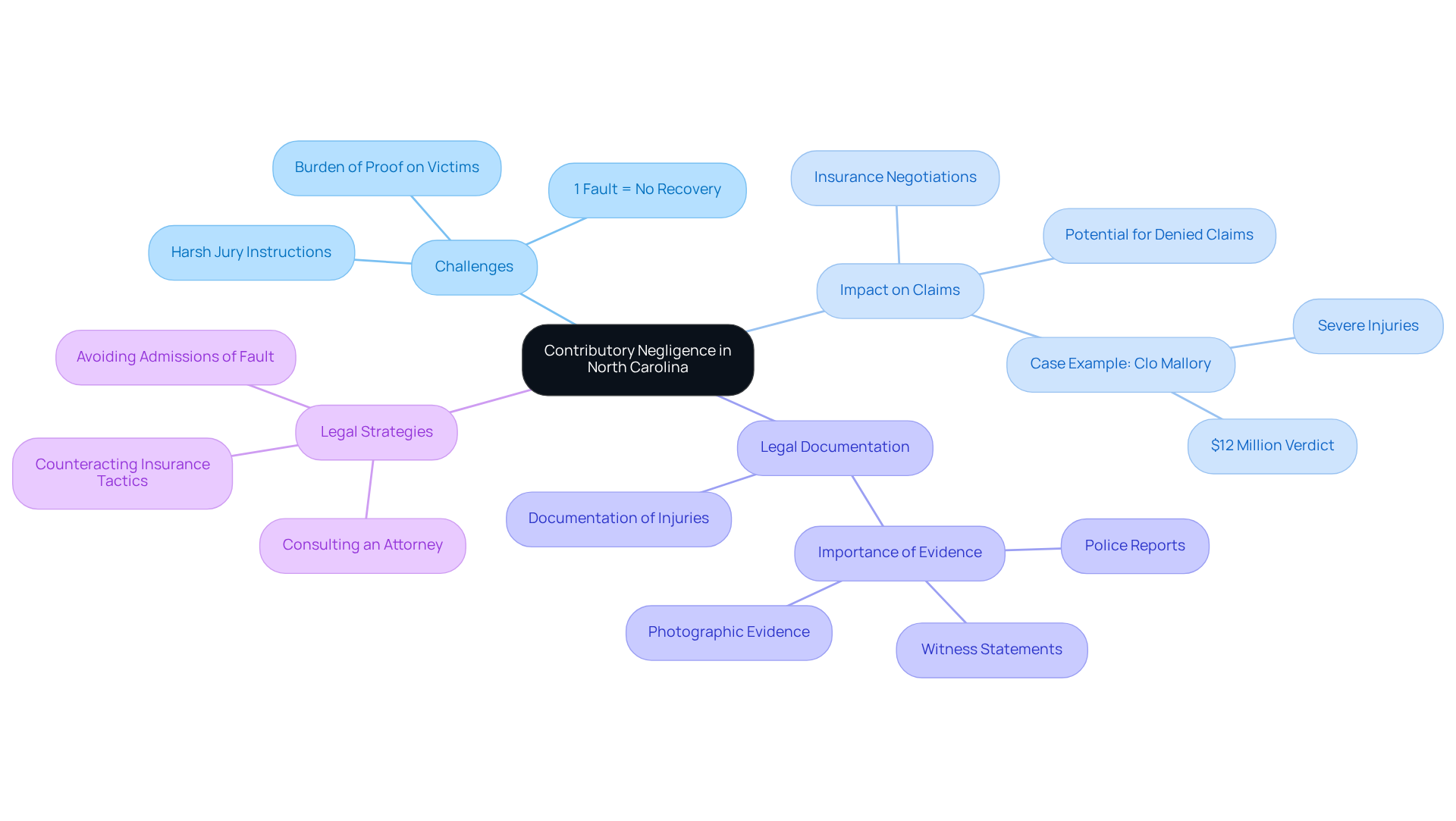

Explore North Carolina's Legal Framework: Contributory Negligence and Its Impact on Claims

In North Carolina, the contributory negligence rule poses a significant challenge for individuals seeking justice. If an injured party is found even 1% at fault for an accident, they are completely barred from recovering any damages. This stringent standard places a heavy burden on those affected, making it essential to provide clear evidence of their lack of fault.

Consider a notable case where a jury awarded a victim $12 million for severe injuries sustained. This illustrates the potential for substantial restitution when fault is clearly established. However, the same rule can complicate settlement negotiations, as insurance companies may exploit this doctrine to deny claims or minimize payouts. Victims must remain vigilant; any admission of fault, no matter how minor, can jeopardize their chances of recovery.

Legal professionals emphasize the critical importance of thorough documentation and evidence collection—police reports and witness statements are vital tools to counteract claims of contributory negligence. Understanding whether is North Carolina a no-fault state is crucial for individuals involved in such incidents, as it directly impacts their legal strategies and potential outcomes in pursuing restitution.

Remember, you don’t have to navigate this alone. We’re here to fight for your rights and ensure you receive the support you deserve.

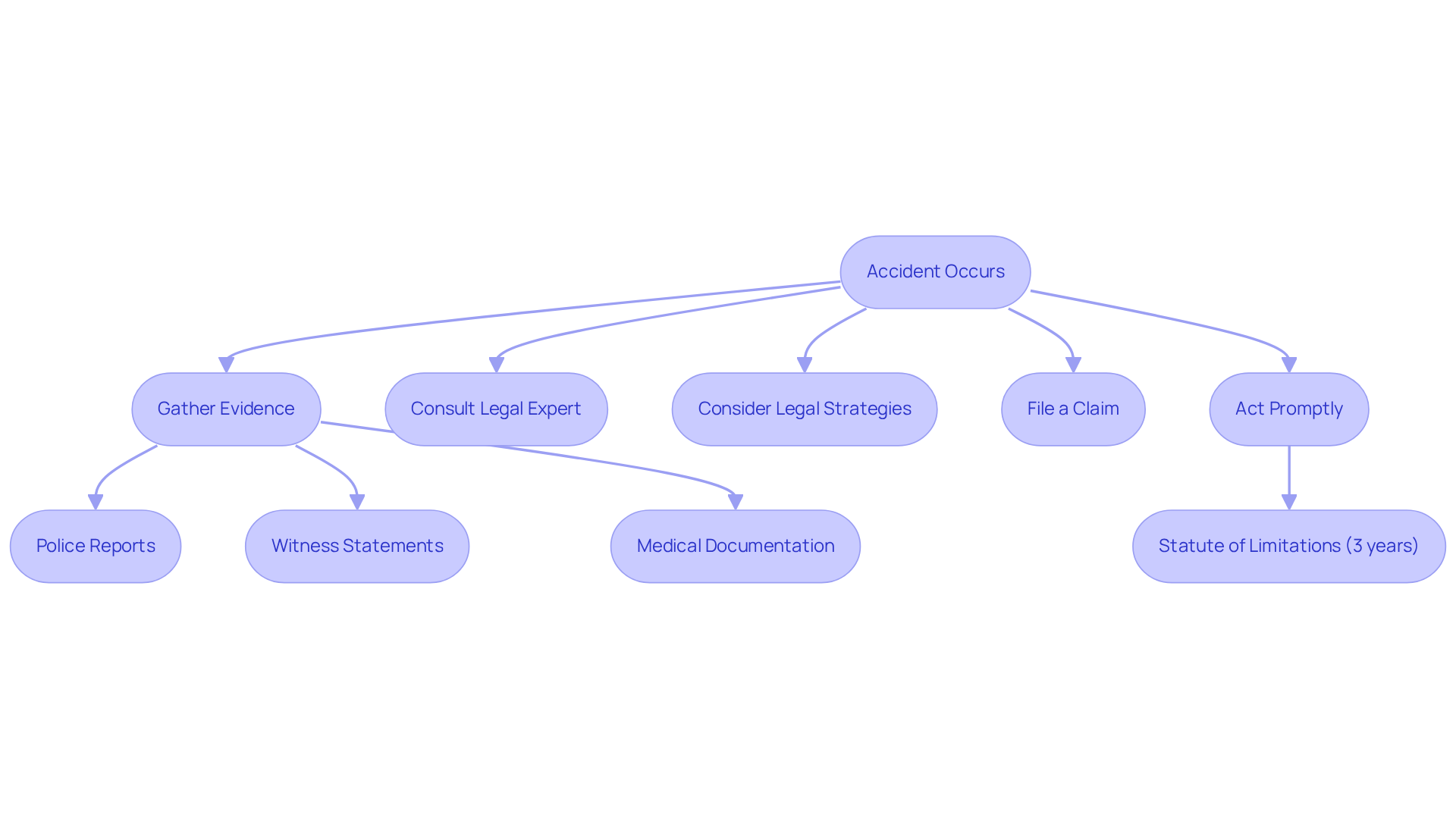

Understand Practical Consequences: Navigating Claims and Legal Options After an Accident

In North Carolina, navigating the aftermath of an accident can feel overwhelming. Understanding whether North Carolina is a no-fault state is crucial, especially with the at-fault system and contributory negligence rules in play. Victims must prioritize gathering evidence, including:

- Police reports

- Witness statements

- Medical documentation

to substantiate their claims effectively. Recording wounds and costs is essential, as it lays the groundwork for any compensation pursued.

Consulting with a legal expert, like those at Vasquez Law Firm, can illuminate the best strategies—whether negotiating with insurance companies or pursuing litigation. Vasquez Law Firm provides prompt legal aid, offering free consultations and 24/7 emergency support for personal harm cases. This ensures that victims have access to the assistance they need when it matters most.

Legal professionals often emphasize the importance of acting swiftly. The statute of limitations for filing claims is typically three years from the accident date, underscoring the need for prompt action to preserve evidence and strengthen your case. By being informed about these practical aspects and leveraging the comprehensive legal support available at Vasquez Law Firm, individuals can take proactive steps toward securing justice and compensation for their injuries, particularly in understanding if North Carolina is a no-fault state.

Additionally, employing effective legal strategies—such as thorough investigations and well-prepared demand letters—can significantly enhance the likelihood of a favorable outcome. Remember, you don’t have to face this alone; we’re here to fight for you.

Conclusion

Understanding the nuances of car accident laws is vital for North Carolina drivers, especially when it comes to whether the state operates under a no-fault insurance system. Unlike no-fault states, where individuals can receive compensation without proving fault, North Carolina employs an at-fault system. This means that injured parties must establish the other driver's liability to recover damages. This distinction significantly impacts how claims are navigated and the potential for compensation.

Throughout this article, we’ve explored various aspects of North Carolina's legal framework, including the implications of contributory negligence, the complexities of at-fault insurance, and the importance of gathering evidence post-accident. The stringent contributory negligence rule means that even a minor degree of fault can bar recovery, making it essential for victims to document their cases thoroughly. Moreover, the role of legal experts in guiding individuals through the claims process cannot be overstated; timely action and strategic planning are crucial.

Ultimately, understanding the differences between no-fault and at-fault insurance systems is crucial for anyone involved in a car accident in North Carolina. This knowledge empowers individuals to make informed decisions and underscores the importance of seeking professional legal assistance to navigate the complexities of their rights and options. By being proactive and well-informed, accident victims can better position themselves to secure the compensation they deserve. Remember, you’re not alone in this fight—we’re here to support you every step of the way. Yo Peleo — We Fight.

Frequently Asked Questions

What is no-fault insurance?

No-fault insurance is a specialized form of automobile protection that allows policyholders to receive compensation for their injuries and damages without needing to establish fault in an accident. Each driver's coverage pays for their own medical costs and lost income, regardless of who is at fault.

How does no-fault insurance benefit accident victims?

No-fault insurance benefits accident victims by minimizing the need for litigation, which can delay compensation. It aims to expedite payments to injured parties, ensuring they receive timely assistance during their recovery.

Is North Carolina a no-fault state?

North Carolina is not classified as a no-fault state. While no-fault coverage exists in approximately 12 states in the U.S., North Carolina has different levels of protection and requirements.

What are the potential limitations of no-fault insurance?

No-fault insurance can limit victims' ability to pursue compensation in specific circumstances, particularly if the harm does not meet a designated severity level.

What changes might occur in no-fault laws in the future?

Some states are revising their no-fault laws in 2025, which may lead to changes in the number of states with no-fault coverage systems.

What is the overall impact of no-fault insurance on the claims process?

No-fault insurance fosters a more efficient claims process, as insurers are required to cover medical costs and lost income quickly, enhancing the experience for those affected by accidents.