Overview

Navigating a bad faith insurance claim can feel overwhelming, but you don’t have to face it alone. Start by thoroughly preparing:

- Review your policy

- Document all communications

- Gather evidence

- Consult with a lawyer

Recognizing signs of bad faith—like unreasonable denials and delays—is crucial. By following a structured process for filing your claim, you can significantly improve your chances of obtaining fair compensation. Remember, we’re in this fight with you.

Introduction

Navigating the complexities of bad faith insurance claims can be a daunting challenge for policyholders. Have you ever felt overwhelmed when your insurance provider fails to uphold their obligations? When faced with unreasonable denials, delayed payments, or inadequate investigations, individuals often find themselves at a disadvantage. This article offers essential steps to empower you, equipping you with the knowledge and strategies needed to effectively address bad faith practices.

How can you ensure that you are not only recognized but also compensated for the wrongs you face in these situations? We’re here to fight for you.

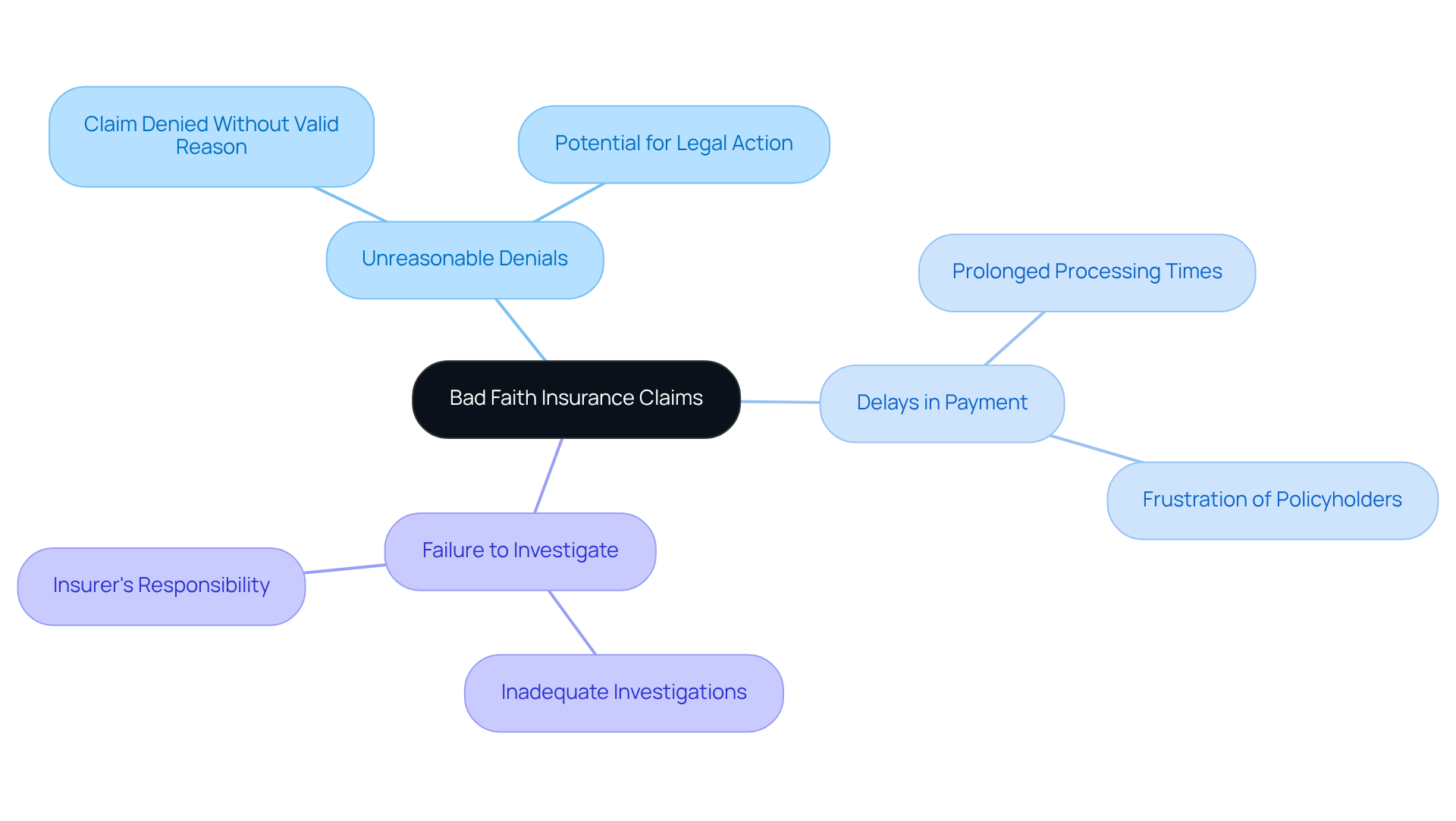

Understand Bad Faith Insurance Claims

Dishonest insurance requests arise when an insurance provider fails to meet its obligations to policyholders. This can manifest in various ways, such as unreasonable claim denials, delayed payments, or inadequate investigations. Recognizing these behaviors is vital for policyholders to determine when their insurer may be making a bad faith insurance claim. Here are key indicators to watch for:

- Unreasonable Denials: A claim denied without a valid reason may signal bad faith.

- Delays in Payment: Prolonged delays in processing requests can be a tactic to frustrate policyholders.

- Failure to investigate properly by insurers can lead to a bad faith insurance claim, as they must conduct thorough investigations.

When it comes to workplace injuries, it's crucial to understand that you might have a separate personal injury case against third parties who contributed to your accident. This could include equipment manufacturers, property owners, contractors, or drivers involved in workplace-related vehicle incidents. The rules surrounding these claims can be complex, and insurance companies often deploy teams of attorneys to defend against disputes. Therefore, recognizing the signs of poor intentions is the first step in addressing an insurer that isn't fulfilling its responsibilities. Legal representation can be essential in navigating these disputes and ensuring you receive the benefits you deserve. Remember, NO GANAMOS, NO PAGA.

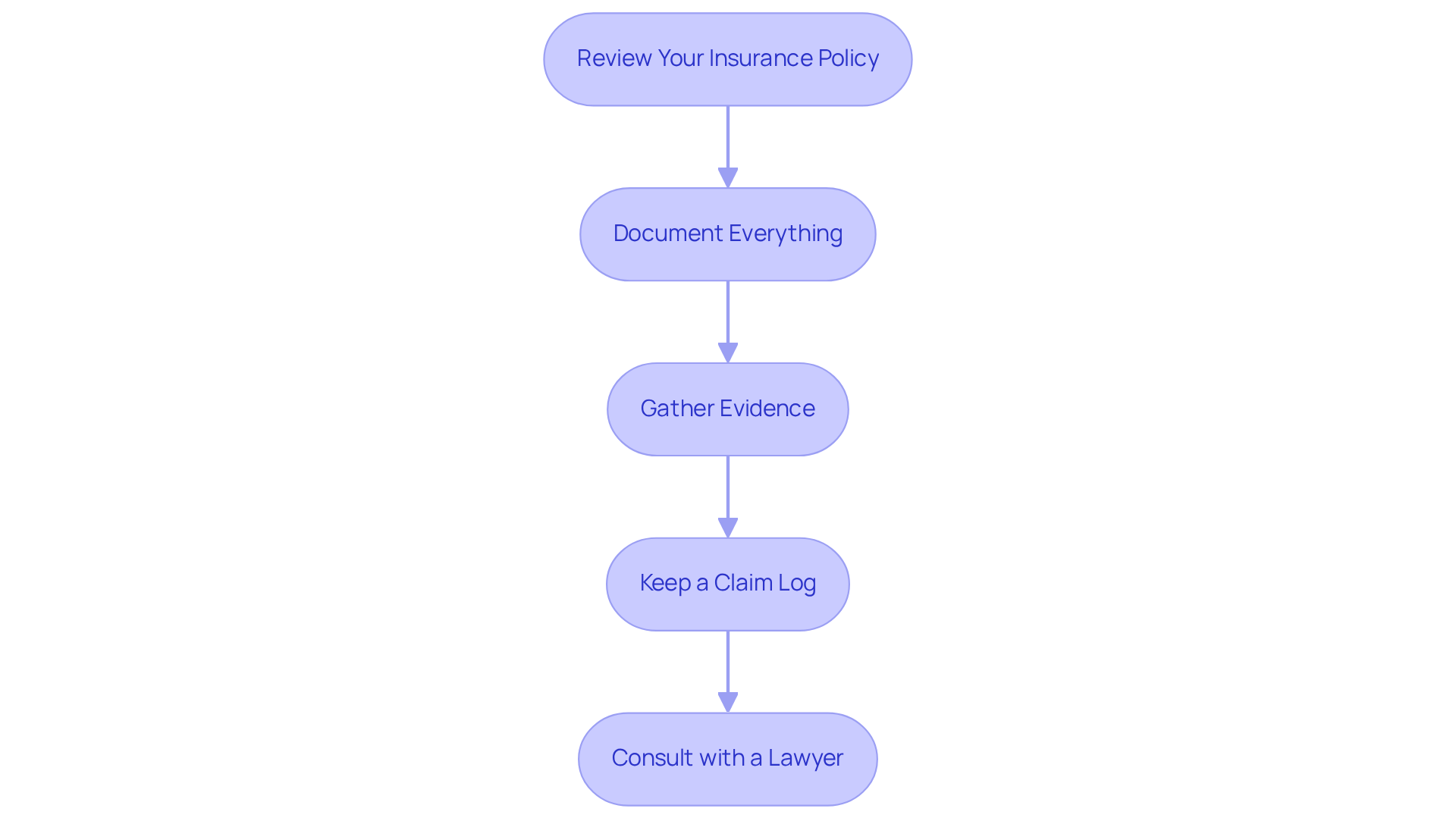

Prepare for Your Claim: Key Initial Steps

Before submitting a bad faith insurance claim, it's crucial to prepare thoroughly. Here are the essential first steps to take:

- Review Your Insurance Policy: Understand the terms and conditions of your policy, including coverage limits and exclusions. This knowledge is your first line of defense.

- Document Everything: Keep detailed records of all communications with your insurance company. Note down dates, times, and the names of representatives you spoke with. Every detail matters in this fight.

- Gather Evidence: Collect relevant documents, such as application forms, denial letters, and any correspondence that supports your case. Evidence is key to strengthening your position.

- Keep a Claim Log: Maintain a log of all interactions with your insurer, noting any delays or unusual responses. This log can be invaluable if disputes arise.

- Consult with a Lawyer: Seek guidance from a lawyer experienced in bad faith insurance disputes. They can help you navigate this complex process. Remember, as an injured worker, you have the right to benefits under workers' compensation laws, regardless of fault. At Vasquez Law Firm, we are committed to providing personalized legal representation to help you through these challenges.

We understand how overwhelming this feels, but you don’t have to face it alone. We’re here to fight for your family and your rights every step of the way.

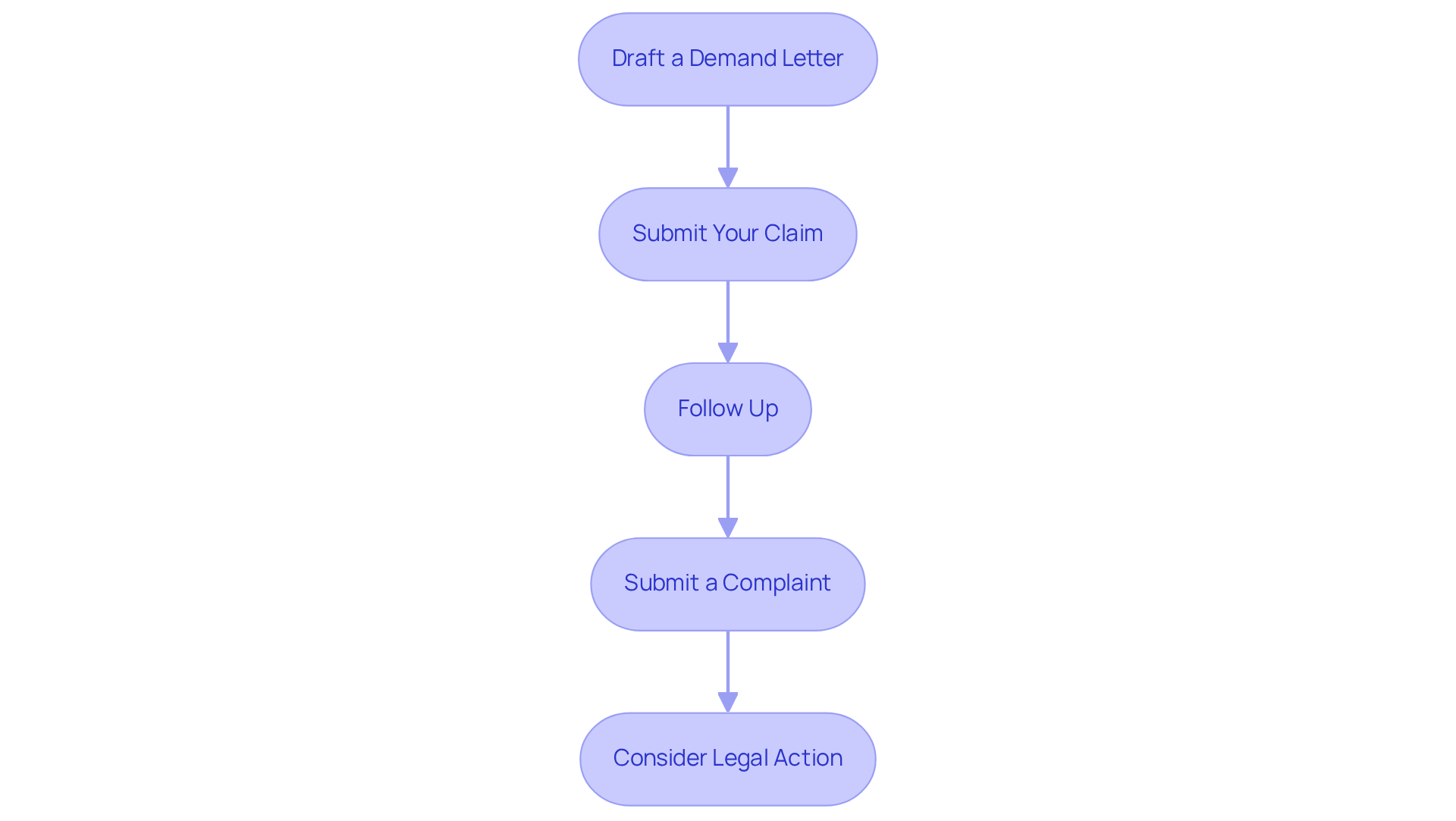

File Your Bad Faith Insurance Claim: Step-by-Step Process

Filing a bad faith insurance claim may seem overwhelming, but it doesn't need to be. Here are the critical steps to take:

- Draft a Demand Letter: Start by writing a formal demand letter to your insurance provider. Clearly detail your request, the basis for your bad faith insurance claim, and the compensation you seek.

- Submit Your Claim: Send your demand letter along with all supporting documentation to your insurance provider. Remember to keep copies for your records.

- Follow Up: After submitting your claim, don’t hesitate to check back with your insurance provider. Confirm they received your documents and inquire about the next steps.

- Submit a Complaint: If your insurance provider fails to respond or continues unethical practices, consider submitting a complaint with your state’s insurance department. You have rights, and it’s important to stand up for them.

- Consider Legal Action: If necessary, discuss with your lawyer about initiating a lawsuit against your insurer for unethical practices. You deserve fair treatment.

For immediate legal assistance, Vasquez Law Firm is here for you. We offer free consultations and are available 24/7 to support you in personal injury cases. If you need help understanding your rights and the process, reach out for emergency support. Remember, you’re not alone in this fight—we’re here to fight for your family.

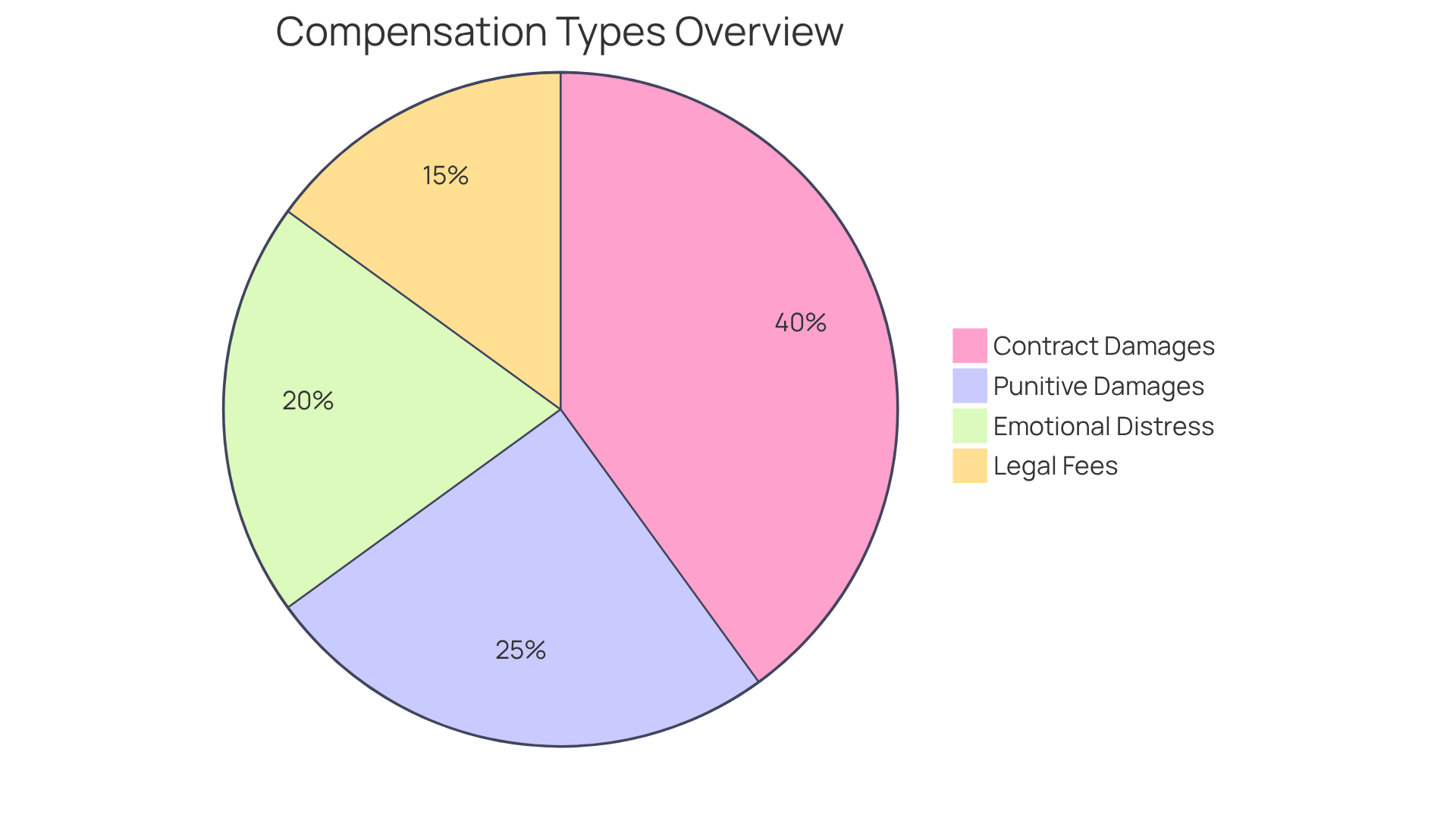

Explore Potential Compensation and Outcomes

When dealing with a bad faith insurance claim, it’s crucial to understand what compensation and outcomes you might expect.

- Contract Damages: You could recover the amount owed under your insurance policy, including any unpaid claims.

- Punitive Damages: If the provider's conduct is particularly egregious, punitive damages may be awarded to punish the provider and deter future misconduct.

- Emotional Distress: You might also seek compensation for emotional distress resulting from a bad faith insurance claim by the insurance company.

- Legal Fees: In certain situations, recovering attorney fees and expenses related to your case may be possible.

The outcome of your claim will depend on the specifics of your case, including the evidence you provide and the insurer's response. Remember, you don’t have to navigate this alone—we’re here to fight for your family.

Conclusion

Navigating a bad faith insurance claim can feel overwhelming, but knowing your rights and the essential steps can empower you as a policyholder. This article underscores the importance of recognizing bad faith practices by insurers, preparing adequately for your claim, and following a structured process to seek justice.

Key insights include identifying indicators of bad faith, such as:

- Unreasonable denials

- Delays in payment

It’s crucial to maintain thorough documentation, seek legal consultation, and understand the potential outcomes for compensation. With these strategies in hand, you can effectively advocate for your rights and pursue the benefits you deserve.

Ultimately, being informed and proactive when facing bad faith insurance practices is vital. If you find yourself in this situation, don’t hesitate to seek legal support. Experienced professionals are here to guide you through this complex landscape. Taking action not only helps secure the compensation you deserve but also holds insurance companies accountable for their obligations. Remember, we’re in this fight with you.

Frequently Asked Questions

What is a bad faith insurance claim?

A bad faith insurance claim occurs when an insurance provider fails to meet its obligations to policyholders, which can include unreasonable claim denials, delayed payments, or inadequate investigations.

What are some key indicators of bad faith insurance practices?

Key indicators include unreasonable denials of claims without valid reasons, prolonged delays in payment processing, and failure to conduct thorough investigations by the insurer.

How can bad faith insurance claims affect workplace injury cases?

In workplace injury cases, there may be separate personal injury claims against third parties who contributed to the accident, such as equipment manufacturers or contractors. Recognizing bad faith practices is important in these situations.

Why is legal representation important in disputes with insurance companies?

Legal representation is essential because insurance companies often employ teams of attorneys to defend against disputes. Having legal support can help ensure that policyholders receive the benefits they deserve.

What does the phrase "NO GANAMOS, NO PAGA" mean in the context of insurance claims?

The phrase "NO GANAMOS, NO PAGA" translates to "If we don’t win, you don’t pay," indicating that legal representation may operate on a contingency fee basis, where clients only pay if their case is successful.